Delaware is a popular place for entrepreneurs looking to form an LLC.

It is characterized by predictable and business-friendly laws, as well as an easy and affordable process for forming LLCs.

However, Delaware has some specific requirements before you can start an LLC.

There are many things to do, including registering with the division, paying all required fees, and meeting all naming information requirements.

Top LLC Services to Start a Delaware LLC

Five Steps to Launch a Delaware LLC

- Step 1: Finalize Your Delaware LLC’s Name

- Step 2: Nominate an agent registered in Delaware

- Step 3: Get your Delaware LLC Certificate of Formation

- Step 4: Create Your Delaware LLC Operating Agreement

- Step 5: Follow Federal, State, And Local Regulations

There are many good things about starting an LLC in Delaware

Delaware is different from other states in that owner information is kept private.

You don’t need to reveal any information about yourself or the owners. You can’t give out any information about yourself or your financial situation to anyone.

Another benefit is the simplicity of LLC formation.

The only thing you need to do is file a Certificate of Formation with the Division of Corporation. Many LLC services, such as IncFile, offer a variety of services to LLCs in the state. This will reduce your stress. This will be discussed in greater detail later.

Delaware allows owners to create a series LLC. This allows a single LLC with multiple divisions (known collectively as series), each with its own assets and members.

The assets of any series that is sued will be protected.

Unlike most other states, you won’t be required to pay any state income or intangible tax.

The Bad Parts of Starting an LLC in Delaware

The registration process may be more complicated if your principal place of business is in a state other than Delaware.

In order to register as a foreign company in your home state, you will need to pay multiple filing fees and submit annual reports. A Certificate of Good Standing (also costing a small amount) may be required from Delaware.

Multiple-state reporting and registration require a registered agent in Delaware as well as your home state.

Many LLCs offer registered agent services in the United States. However, it is important to select the right one. You’ll end up with multiple agents from different states.

Even though it is convenient, Delaware’s oral LLC operating agreements can be problematic. Talks between LLC members may be misinterpreted and the parties involved could lie.

This is why it’s important to have an operating agreement written, even if it’s not required by law.

Step 1: Finalize Your Delaware LLC’s Name

The first step in your LLC formation process is choosing a name.

The choice of a Delaware business name is more than branding. You must also meet certain legal requirements. Another requirement is to check availability to make sure no other businesses have filed for it with the Division of Corporations.

Follow these Naming Guidelines

Delaware law, like other states, requires that LLC owners choose a unique name. There are also other things to remember:

- The LLC name must be distinct from all other Delaware LLCs, corporations, or partnerships

- LLC names must contain the phrase “limited liability corporation” or one of its abbreviations, such as L.L.C. or L.L.C.

- The name of an LLC cannot contain words that could cause confusion between your company and a government agency (Treasury or FBI, State Department, etc.).

- If the LLC name contains restricted words (Bank or Attorney, University, etc.), you will need to fill out additional paperwork.

Check Name Availability

If you use a Delaware name that is already in use, you’ll be subject to a penalty. You should search for the name you are looking for on Delaware Entity Search at the Department of State’s site. You can use the name if it is available. You will need to create a new name if someone already has the name.

Verify URL Availability

Perhaps you have thought about setting up a website to promote your business. It doesn’t matter if you’ve already thought about launching a website for your business.

Even if you don’t intend to build a website for your business right away, I recommend purchasing the URL to stop other businesses from buying it.

Registering to be a DBA (Optional).

Your LLC can be operated under a different name than your company’s legal name.

You will need to register a DBA (or “doing business under” in Delaware. You must complete the Registration Of Trade, Business & Fictitious name Certificate form and submit it to each county Superior Court in which you do business.

This form requires notarization and will require you to pay $25 in filing fees.

Step 2: Nominate a registered agent in Delaware

If you are looking to create an LLC in Delaware, it is mandatory that you nominate a Delaware registered representative.

A registered agent is an individual/business entity that receives important federal and state correspondence, tax forms, and notices of lawsuits on your behalf. They are the point of contact for your business with the state.

This person or entity must also be a Delaware resident or have a Delaware street address.

Although you can choose to be your company’s registered agent, it is easier to hire an LLC that provides reliable services. This is my top choice.

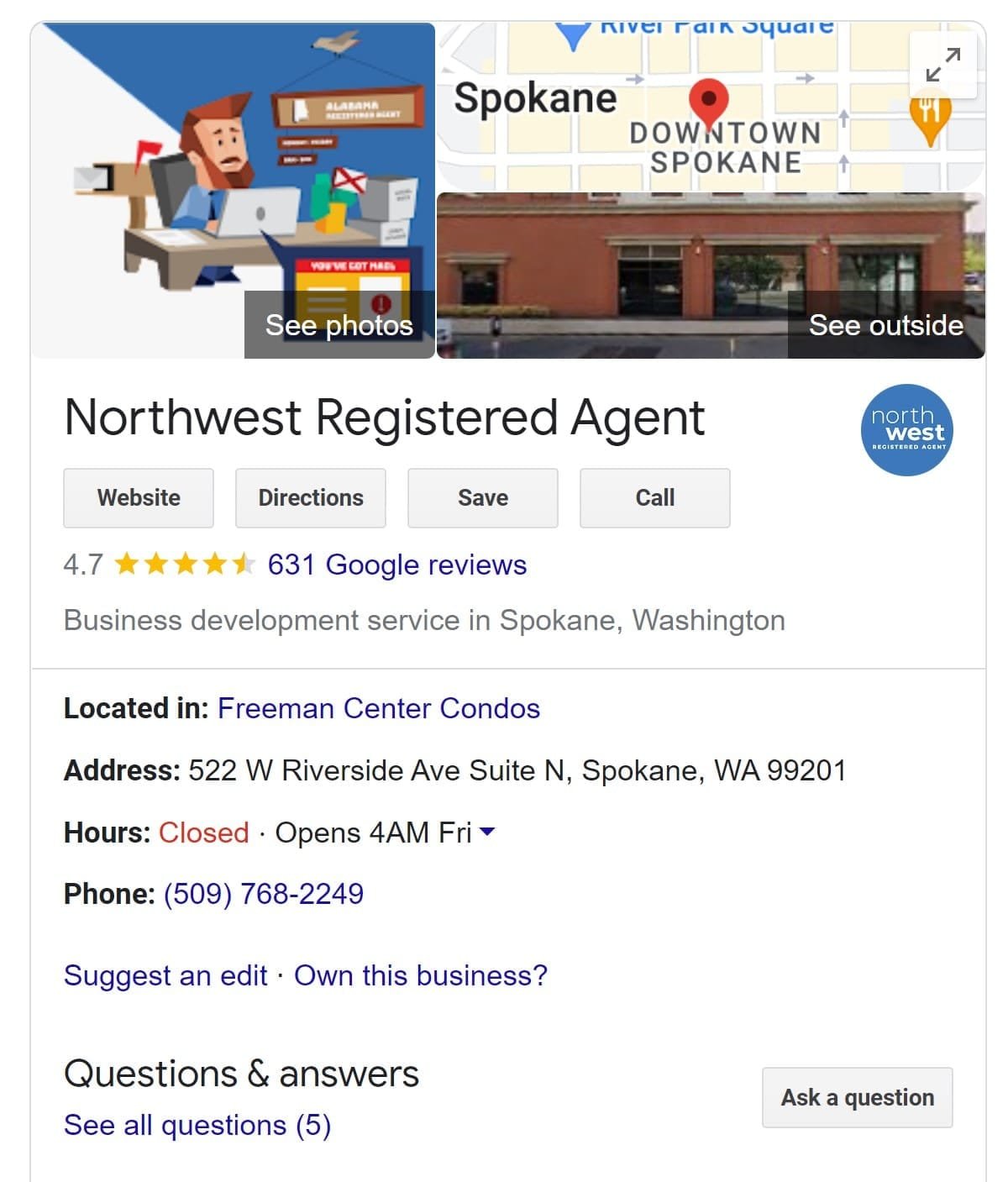

Northwest Registered Agent

Northwest Registered Agent holds the #1 spot on our list of top-rated LLC formation services.

It has a large library of materials to assist budding entrepreneurs in deciding what type of business they should start. The software then helps them with paperwork and filing procedures. All this for as low as $39.

You get registered agent services free of charge for your first year.

Step 3: Get your Delaware LLC Certificate of Formation

Next, you will need to file your Certificate of Form (also known in other states as the Articles of Organization) online with the Delaware Division of Corporations. You also have to pay a filing fee.

Don’t worry too much because you have already engaged an LLC service to handle your documentation. It’s an important step. I’ll go over it in detail.

Get a Delaware Business License

Delaware has very strict requirements regarding business licenses. The Delaware Department of Revenue must issue a state license for the business.

Create a “One Stop” account to obtain a business license. You will also need to pay a filing fee. The fees will vary depending on what type of business you have and can range from $50 to $450.

Once you have completed the online process, you will receive a temporary license valid for 60 days. Generally, permanent licenses are sent within 10 working days.

Additional licenses may be required by some Delaware counties and cities. Contact local government agencies to find out the additional licenses required to run your LLC in Delaware.

The Delaware LLC Certificate of Formation

The Certificate of Formation can be filed online or by mail.

When filing, you will need to provide the name of your business and information about your registered agent. The application must also be approved by the Delaware Secretary Of State.

Delaware law only requires that you file a Certificate Of Formation once. If you change the name of your business or the registered agent of your company, you will need to file a Certificate of Amendment.

Keep your Certificate of Formation safe

Once you receive your paperwork after approval, keep your Certificate of Formation and any other important documents safe. Although it may seem obvious, you will be amazed at how many LLC owners lose important documents. Do not be like them.

Step 4: Create Your Delaware LLC Operating Agreement

After receiving approval from the Division of Corporations, your Delaware LLC is now legal. Congratulations!

There are however a few steps that must be completed before the final approval can be given. Delaware LLC owners must adopt an operating agreement.

An operating agreement is a legal document that outlines the business ownership and operating procedures for a particular LLC. It is a legal document that ensures all business owners are on the exact same page. This reduces the likelihood of future disputes and misunderstandings.

Although the law does not specify when the agreement must be entered into, it is common to do so shortly after you file your Certificate of Formation. Although you can make a verbal agreement with the other party, it is better to have a written operating agreement.

The Operating Agreement should be drafted

An operating agreement is a detailed document. It should describe your business structure and outline the individual responsibilities of each member.

Your operating agreement should contain the following minimum:

- The purpose of setting up an LLC.

- Names and addresses for each LLC member as well as the manager, if applicable

- The LLP is enriched by each member’s contributions.

- Each member has a share of the profits or losses, as well as an ownership interest and voting rights.

- Acceptance of new members

- If the LLC is managed by a manager, there are procedures for choosing a manager

- Meeting schedule and voting procedures

- Dissolution

Each member of an LLC should read and sign the operating contract. The document doesn’t need to be filed with the state. Instead, you can file it along with key business records.

Step 5: Follow Federal, State, And Local Regulations

To create an LLC in Delaware, you must comply with all applicable federal, state, and local regulations. These regulations can vary depending on where you live and what your business is, but here are the main ones to remember:

Apply for an EIN

EIN is an acronym for Employer Identification Number. This nine-digit number is assigned by the Internal Revenue Service to businesses for tax purposes. It is your company’s Social Security number.

While it is not required for all LLCs you will need an EIN if your company has multiple owners or plans to hire employees. You will also need an EIN to open a bank account for your business.

Take control of your tax obligations

Delaware does not have a sales tax. However, LLCs operating in Delaware must comply with other tax requirements. If you have employees, you will need to pay both federal and state taxes.

All Delaware LLCs are required to pay $300 in annual taxes and gross receipts taxes, depending on the type of business. Each member of an LLC must also pay state income tax on personal tax returns unless the LLC is elected to be taxed like a corporation.

Respect your Employer’s Obligations

Employers must meet certain requirements when hiring employees. These include reporting new hires, paying unemployment and payroll taxes, and purchasing worker’s compensation insurance.

All Delaware employers must register with the Division of Workers’ Comp after hiring their first employee. This applies regardless of whether they are full-time employees or part-time.

Business808, a renowned consulting organization that aids startups in scaling and growing, is led by Andy Brooks as Editor-in-Chief.

Andy has over 12 years of consulting experience and is a pro at creating and managing profitable businesses. He has experience working with several LLCs and Registered Agent services and has a degree in business management. Andy enjoys providing useful information for Business808.

In addition to writing for Business808, Andy is a well-known author and speaker, and an active contributor to several online business publications, imparting his knowledge on how to grow an LLC.