LLC Services • Registered Agents • Incorporation Services

Guides for Online Business Formation

Limitless Possibilities

Creating a Business Entity Online With a Good Formation Service is the Easy & Affordable Way to Go.

The top-rated LLC services know the requirements of your state and they can guide you through the formation process.

Business808

Recent Posts…

Best Arkansas Registered Agents

Best Alabama Registered Agents

Best Alaska Registered Agents

Best California Registered Agents

Best Colorado Registered Agents

Best Delaware Registered Agents

Find the Best registered agent Service for Your Business

Registered Agents Either for an LLC or Corporation Help Millions of Businesses Everyday With Staying Compliant While Providing a Layer of Privacy.

How to Start an LLC

One of the most critical steps in starting a business is to set up a limited liability company (LLC). An LLC will provide your business with liability protection and other benefits. This guide will show you how to create an LLC in seven easy steps. Our guide to the best LLC service providers will provide more information to help you organize all your documents.

What is an LLC?

The LLC is one of the legal entities that U.S. business owners have the option to use for their business. An LLC is a way to protect an individual or group’s assets in the event of bankruptcy or legal trouble. Flexible taxation options are possible because not all businesses operate the same way. While some may choose to be treated as sole proprietorships, others may opt for corporate taxation. Talk to a tax advisor about the best option for your LLC.

How to Set up an LLC

This seven-step guide will help you start your LLC. There are many differences between states in the laws and processes. For information specific to your state, please consult our state LLC formation guides.

1. Choose a business name

When you are thinking about names for your company, marketing may be top of mind. While it is important to choose a name that will be memorable, you must also ensure your business meets state laws.

State laws generally prohibit you from choosing a business name that is already used in another state. Many states prohibit words that could imply that you are involved in a particular business, such as insurance or banking. You will likely need to add some form of “LLC” (or “limited liability company”) at the end of your business name.

By visiting the website of your state agency responsible to business filings (usually, the Secretary of State), you can check the LLC naming requirements in your state and see if the name that you are looking for is available.

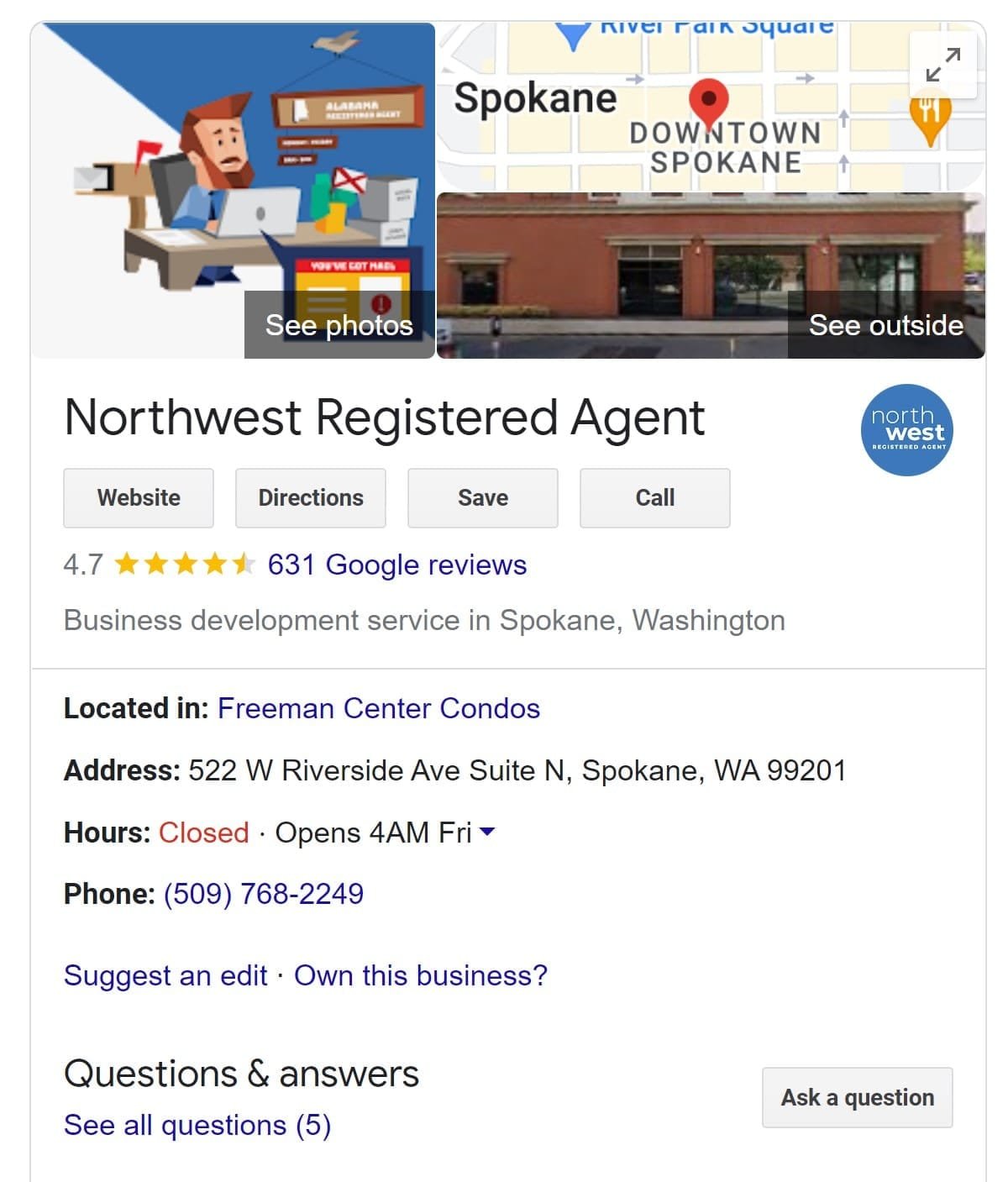

2. Designate a registered agent

Each state requires that LLCs have a registered agent. A registered agent is someone who accepts official or legal documents (such as subpoenas), on behalf of the LLC. The registered agent receives the documents and then forwards them to the LLC.

A registered agent can be anyone over 18 years of age. You are allowed to name you or your employee. The agent must be accessible at your address during normal business hours. A company can also be designated as a registered agent. You will need to pay a fee for this service. Prices for registered agents can be more than 100 dollars per annum.

Do I need to be my own registered agent?

Legally, you can act as your registered agent in any state. This option is not available to everyone. You should be aware that your name, address, and email address will soon become public records if you choose to register your LLC’s agent.

As your LLC’s registered agent, you must receive and manage important legal notices or documents. You may not be as familiar with local laws as you think and would have difficulty managing this type of paperwork.

Before becoming the registered agent for your LLC, you should research the best registered agents, it is important to carefully consider all options.

3. Request a copy of the Articles of Organization from your State

You will need to file paperwork with your state agency responsible for business filings in order to establish your LLC. This document is known in most states as the articles of organization. However, some states use a different name such as a certificate for formation. You can use a different form for each state. Go to the same website where you did business name research to find the state’s form.

4. Prepare the LLC Articles form

Each state has its own requirements and procedures when forming an LLC. The following information is essential:

- Your business name

- Your principal place of business address

- The purpose of the business

- How your LLC will be managed

- Contact information of the registered agent (and, in some states the signature of the agent)

- The term of the LLC

After these steps have been completed, one or more of the business owners or organizers must sign the form.

In some states, like New York and Nebraska, you will need to publish a notice in a newspaper indicating that you are interested in registering your LLC. Before you can file the articles of organization, this step must be done.

5. Fill out the LLC Articles of Organization

Before submitting your articles of organization to your state, make sure you carefully review them. A filing fee will also be required depending on where your business is being formed.

Once your LLC’s formation documents have been approved, the state will issue you a certificate to show that your LLC has been officially registered. It can be used for other tasks, such as opening a bank account or obtaining a tax ID number.

6. Make an Operating Agreement

An operating agreement outlines the legal, financial, and managerial rights of each member of the LLC. It can also include details about how profits will be divided, who leaves the LLC, and who contributes capital. It should include all information relevant to the operation of your LLC.

Although many states do not require operating agreements, it doesn’t mean that you shouldn’t. Operating agreements are important for LLCs that have more than one partner or member. This will ensure that everyone is on the same page about their rights and responsibilities. Even sole proprietors of businesses can benefit from putting the details in writing.

A good option for single-member LLCs is to create your own operating agreement. There are many templates available online that can be used as templates. An experienced attorney might be a good investment for more complicated situations, such as LLCs that have multiple owners.

7. Keep your LLC active

The first step in setting up an LLC is the most important. After your LLC is established, you will need to maintain good standing with your state. For current information, visit your state’s website on business filings. An annual report may be required to update information about your LLC. You will also need to pay an annual filing fee.

Other important tasks when creating an LLC

There are some key details that you need to know in order to create an LLC.

Get Business Permits and Licenses

You will need documents to establish your LLC. Additionally, you will likely need to fill out forms and pay fees for business licenses or permits. These forms and fees can be found at the office or on the official site.

Check with your state’s licensing and fees requirements to ensure your business is legally operating in your state. Keep in mind important deadlines as you may need to apply for renewals of your permit or license periodically. Failure to comply with renewal requirements could result in your LLC losing its legal status.

Register for an Employer Identification Number (EIN).

Anyone who wants to form an LLC must obtain an EIN. It is a crucial tool for separating your business and assets from your personal finances. Banks often require an EIN to open a business account for LLCs. An EIN is required for certain businesses. Your EIN should be obtained as soon as your company is established. You can apply for an employer identification number (EIN) on the IRS website.

Divide business and personal assets

Specific actions can help you separate your personal assets from your business assets. This can be done by obtaining an EIN or opening a bank account for your business.

Another concern for LLC members and owners is how to pay their own salaries. This usually involves withdrawing money from your LLC’s business account. This would be called an “owner’s withdrawal.” It allows you the ability to treat yourself like an employee and avoid the problems that can arise from spending company money for personal use.

Why form an LLC?

For entrepreneurs or groups looking to start a new venture, LLCs are a popular choice for business formation. There are many reasons people choose to form LLCs.

- A limited liability company is often less expensive to start than a corporation. Some states have fees that are lower than $100. LLCs are a great business structure for people who want to start a company but don’t have the capital to do so.

- Tax-related Benefits: LLCs can be treated like pass-through entities. This allows them to be claimed on personal taxes even if business assets are separated from one’s financials. This option is preferred by many LLC owners as it avoids double taxation. However, LLCs can be treated tax-wise as a partnership, sole proprietorship, C-corporation, S-corporation, or partnership.

- Liability protection: As the name suggests, an LLC gives members and owners some liability protection. If the company is sued, members can protect their assets by designating the assets of the business.

It’s not difficult to learn how to create an LLC. There are many companies that can help you with the paperwork, as well as handle your yearly obligations such as annual reports.

There are many types of LLCs to consider

There are many options for LLC formation. Knowing the available options is crucial for choosing the right business model for your company. These structures are:

- A single-member LLC: The LLC is owned by one person. Although it is similar to a sole proprietorship this LLC offers additional tax benefits as well as liability protection.

- Multi-member LLC: Standard LLCs that have more than one member are often divided into member-managed and manager-managed entities.

- L3C: These entities are also known as “low-profit liability companies” and act as a bridge between nonprofit LLCs (for-profit LLCs) where the business cause is the main focus, rather than the earnings.

- Series LLC: Series LLC’s tiered business structures allow the topmost LLC to own a series of lower-tiered LLCs via unlimited segregation. Each LLC operates independently from the others; their assets are also primarily separate.

- PLLC: This type of business formation is available only to licensed professionals.

- Restricted LLC: Limited LLCs are exempt from tax for the first ten years of their formation. They cannot also make distributions to members. The articles of organization must state that the LLC is restricted.

Uncommon: Anonymous LLC

This type of entity doesn’t have a legal name. An LLC is deemed “anonymous” if the state doesn’t publicly identify its owner. Many details about business formation are public records, so it is understandable why someone might want to keep their personal information as private as possible. A single-member LLC owner might be able to operate from their home, but they may not wish this information to be public.

Most states do not permit LLCs to be created anonymously. This option is currently limited to Wyoming, Nevada, New Mexico, and Delaware.

What Does it Cost to Start an LLC?

Costs for forming an LLC vary depending on where it is located. To file your LLC paperwork, you could pay as low as $40 or as high as $500. This does not include any other costs such as the cost to reserve a business name or expedite the process. For your LLC, you may need to purchase business licenses and permits.

It is important to take into account more than just the paperwork required to create an LLC. This includes annual obligations like annual reports and registered agent fees.

What is the tax treatment of an LLC?

The state where the LLC is located and the tax status of the owner will determine how it is taxed. If the LLC is treated as a pass-through entity, it can be claimed on your personal taxes. There will be additional taxes to consider if the LLC is elected to be taxed either as a corporation or partnership. Franchise taxes are applicable to LLC owners in fifteen states.